Macro strategist Lyn Alden believes that Terra’s (LUNA) recent Bitcoin buying spree could be the catalyst that triggers a capitulation event for BTC and the rest of the crypto markets.

Over the last few months, the Luna Foundation Guard (LFG), the non-profit organization built to support Terra, has been aggressively accumulating BTC to the tune of $1.63 billion.

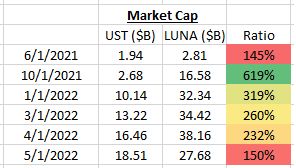

According to Terra founder Do Kwon, the massive Bitcoin buys are designed to back Terra’s native dollar-pegged stablecoin TerraUSD (UST).

Now, the macro strategist tells their 410,700 Twitter followers that a sharp decline in LUNA’s valuation might force the LFG to tap into its Bitcoin reserves to keep UST stable.

“If Luna has a similar price decline to Fantom (FTM) or some of these other hard-hit cryptos, the UST peg would be at risk. If the UST peg becomes at risk, the LFG would be selling Bitcoin reserves into an already soft market. That type of event could mark a cycle capitulation.”

Alden also points out another risk where bearish market conditions force UST holders to convert the stablecoin into LUNA or BTC in an effort to cash out.

“Unlike a crypto-collateralized stablecoin, there is no specific threshold where UST breaks. However, if LUNA gets small relative to UST, the probability of an algorithmic bank run increases… Many of them would liquidate their BTC for cash since their positioning at the time was meant to be a stablecoin.”

The macro analyst also highlights another risk involving the Anchor Protocol (ANC), a savings and lending borrowing platform built on the Terra blockchain that allows users to earn as much as 19.5% in annual percentage yield (APY).

According to Alden, Anchor Protocol’s high APY is a double-edged sword as it serves as both a demand creator for UST and a ticking time bomb that could go off.

“Then there’s the unsustainable Anchor yield timebomb. The time bomb is not about how well-managed the yield decline will be. It’s about what happens to UST demand structurally, when the primary demand driver (artificially high Anchor yields) no longer exists.”