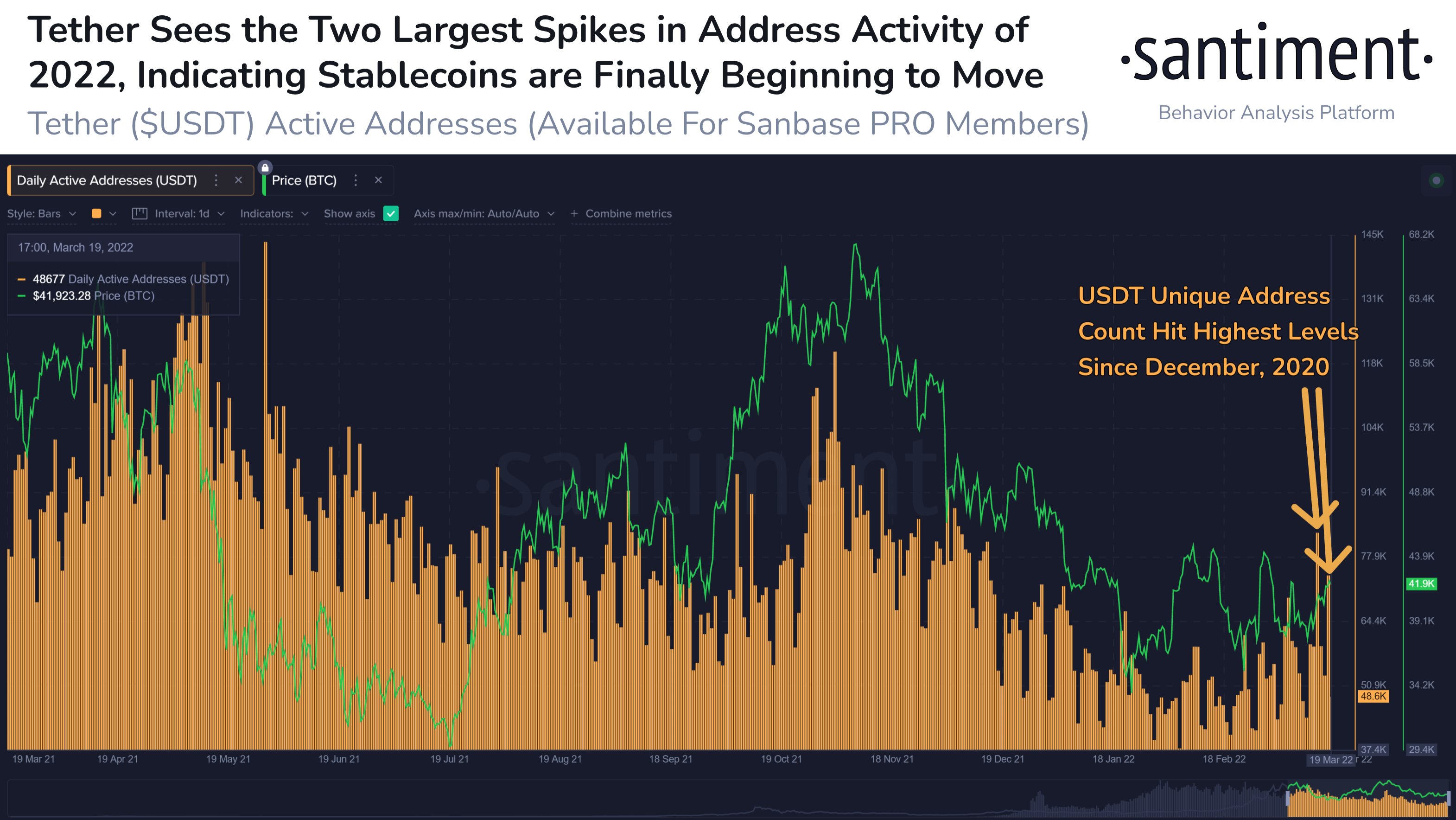

A leading crypto analytics firm says that surging Tether (USDT) activity could mean big price movement on the horizon for the overall crypto markets.

In a new tweet, Santiment notes that last Thursday and Saturday were the two largest days of 2022 in terms of USDT active addresses interacting on the network.

According to the analytics firm, whether the stablecoin activity surge will be bullish or bearish for crypto remains to be seen.

“Historically, gradually rising active addresses are bullish. A massive cluster of spikes all at once can be a bit more of a volatility marker.”

Santiment also notes that the average Bitcoin (BTC) exchange funding rates over the weekend indicated traders were placing long positions on the leading crypto asset by market cap.

That corresponded with BTC’s price drop on Sunday, as the crypto analytics firm explains,

“Funding rates have been valuable in identifying when traders are leverage longing, which have generally led to abrupt price corrections.”

Bitcoin is trading at $41,950.00 at time of writing after hitting a local high of $42,240 on Saturday. The top-ranked crypto asset by market cap is up more than 4% from where it was priced one week ago.

Originally Published Here